Contracts typically make small mentions of Default Interest that a party to a contract may not take much note of it. However, it is an important part of the contract that the seller may rely on to require the buyer to make additional payments for failing to meet a payment obligation under the contract on time.

What is Contract Default Interest?

Contract default interest is a provision in the Contract that allows the Seller to charge the buyer on any late payment. Contract Default Interest typically commences when the buyer fails to meet their payment obligations under the contract, and the interest continues to grow until the day the buyer fulfils their obligations.

When is Contract Default Interest an option to consider?

Contract Default Interest is typically enforced when

the buyer requests an extension of the settlement date.

The reasoning behind this is that the seller is obligated to hold ownership of the property longer than what was agreed because the buyer was not

- ready,

- willing and

- able to settle by the agreed date.

In this scenario, default interest would be payable by the buyer daily until the parties are able to affect the settlement of the property or at a time the seller elects if it is before the settlement date.

How much can a seller charge for Contract Default Interest?

All contracts should make provisions to contract default interest rates.

A typical Real Estate Institute of Queensland contract, commonly used for residential and commercial contracts, makes reference to the Default Interest Rate on page 3.

If the Seller wished to enforce a precise interest rate, they would fill in that section, however, it is commonly left unfilled.

The Default Interest Rate being left unfilled does not stop a Seller from enforcing Default Interest Rate if a buyer fails to meet its obligations to make a payment under the contract. Instead, the amount of Default Interest Rate will be determined by the Queensland Law Society, which is published on their ‘Interest Rates’ page.

The standard contract default rate set by the Queensland Law Society, effective from 1 April 2023 is 10.61%.

How is Default Interest paid and what factors are taken into account when calculating Contract Default Interest?

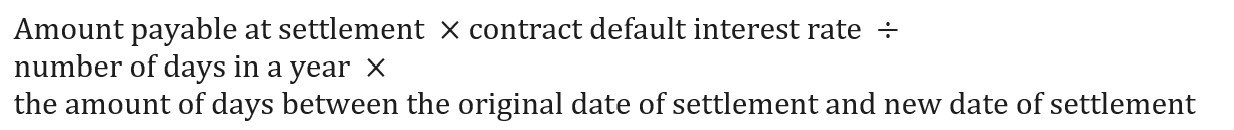

Contract Default Interest is typically paid by the buyer by way of a settlement adjustment to the balance purchase monies in favour of the seller. The parties’ solicitors still calculate typical settlement adjustments (see our article on The Settlement Adjustment Process to see what these adjustments are) and a default interest rate adjustment is calculated as follows:

As you can see above, default interest is calculated based on

- the amount payable at settlement multiplied by the default interest rate,

- divided by the number of days in the calendar year,

- multiplied by the number of days between the original settlement date and the new settlement date (to account for the daily interest rate accrued).

Is a Seller required to enforce Contract Default Interest if the Buyer fails to meet a payment obligation?

A seller is not required to enforce Contract Default Interest if a buyer fails to meet a payment obligation in the Contract, rather it is a remedy available to the seller if they would like to enforce it.

If the seller would like to enforce contract default interest, they must convey that to the buyer and their solicitors in writing and it is up to the buyer whether to proceed.

If you require assistance with purchasing a property in Queensland then please contact the property team at NB Lawyers, Lawyers for Employers for more information.

NB Lawyers – Lawyers for Employers undertake and offer an obligation free consultation – we are happy to help.

Reach out via [email protected] or +61 (07) 3876 5111 to book an appointment.

Written by

Kayleigh Swift, Associate

NB Lawyers – Lawyers for Employers

[email protected]

(07) 3876 5111

AND

Chloe Skubis, Graduate Law Clerk

NB Lawyers – Lawyers for Employers

[email protected]

(07) 3876 5111

About the authors

Kayleigh Swift is an associate in our Commercial and Property team who assists with Employment Law matters. With a high level of experience in commercial and retail leasing, voluntary and involuntary purchase and sale acquisitions, property development and employee relations, Kayleigh provide practical advice to ensure smooth business transactions.

Chloe Skubis is a Graduate Law Clerk in our Property team who assists with various conveyancing transactions. Chloe is very experienced in residential conveyancing and is a problem solver. She always provides efficient service to all her clients.