Unlike utilities such as electricity and telephone, there are certain charges that attach to a property and remain with it even if sold. This is important to consider when buying or selling a house because it means the liability for these charges needs to be established. To determine who these charges apply to is by way of a settlement adjustment process. This settlement adjustment process apportions the outstanding bills between the parties and determines the final amount the vendor receives, and the purchaser pays. These charges include mortgage fees, land tax, rates, water and sewerage charges.

Searches

To begin the settlement adjustment process, it is important to obtain searches close to the settlement date because they will provide information about the current status of the property’s outstanding bills. These include a title, land tax, water and rates search. Obtaining these searches mean you can see if the vendor has any balance outstanding or if they have paid in advance. It is important to identify these facts because they will directly affect the overall purchase price in different ways. For example, if the vendor has balance outstanding, this will be a ‘less’ on the purchase price. If they have paid in advance, it will be a ‘plus’ on the purchase price. Once you have the relevant searches, you can commence the adjustment process. The adjustment process revolves around the adjustment date, or in other words the date the possession of the property shifts to the buyer. This is because often bills will be charged quarterly however half way through the quarter, possession of the property may change, therefore, the bill becomes liable to both parties and must be apportioned to the relevant amount of days each party has possession.

Mortgage

In a property sale, it is important to note how many, if any, mortgages are currently secured by a property. This is because when mortgages are released at settlement, a fee applies for each one. These fees are a ‘less’ adjustment on the purchase price because the purchaser will incur the costs when they transfer the property after settlement. You can find out any relevant mortgage information on a title search. Additionally, it is also important to be aware of any Writs and Statutory charges that may be included on a property’s title search. This is because it can mean that a third party has rights to the land. To remove any Writs and Statutory Charges a Form 14 – General request to remove the charge, must be lodged.

Deposits

If you make a deposit on a house, this will be a ‘less’ adjustment on the purchase price because it will be subtracting the deposit amount from the purchase price to determine what is left payable to the vendor.

Council Rates

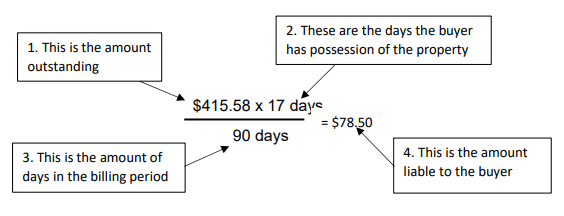

Council rates are issued for different periods depending on the council and provide any outstanding balances. It is important to consider which council the property is in to ensure any future cheques are being addressed to the correct council. The way this adjustment is determined is as follows:

As you can see, the amount outstanding is multiplied by the amount of days the buyer has possession of the property which is then divided by 90 days (which is equal to the quarterly billing period). The amount shown in the diagram above is a ‘plus’ adjustment on the purchase price because it is a fee liable to the buyer.

Water

Water searches provide information about the water access and sewerage charges. This requires a special meter reading to get accurate figures to use in the adjustment calculations. Once again, water and sewerage usage are payable for different periods depending on the water utility company which means it will be apportioned between the parties.

Land Tax

Land tax is a required search to ensure any land being purchased has no preexisting land tax owing on it. It is important to identify if there is any owing because once you have possession you may be required to pay the tax. If in the case there is current land tax, a clearance certificate must be applied to protect the buyer from paying the vendors land tax. If there is outstanding land tax, it is normally paid out of the settlement funds and once full payment has been received, a clearance certificate will be issued by the Government to declare that there is no land tax payable on the land at the time you plan to take possession of it.

Cheque Directions

The final adjustments made will be the disbursements. There will be several cheques payable that need directions from the vendor. These cheques include:

• Any outstanding charges determined through the searches;

• Legal fees; and

• The final purchase price.

If you have any questions about how the settlement adjustment process works, please contact our office on (07) 3876 5111 for a consultation.

Written by

Kayleigh Whittaker, Senior Lawyer

NB Lawyers – Lawyers for Employers

[email protected]

(07) 3876 5111

About The Author

Kayleigh Whittaker is a senior lawyer on our Commercial and Property team who assists with Employment Law matters. With a high level of experience in commercial and retail leasing, voluntary and involuntary purchase and sale acquisitions property development and employee relations, Kayleigh provides practical advice to ensure smooth business transactions.